Achieving a Unified Balance With Universal Accounts

How Particle Network is Streamlining Blockchain Onboarding & Interactions with Universal Accounts

This chain abstraction series article was made possible thanks to our partners, Particle Network and Everclear, two projects at the forefront of improving the web3 experience for users.

Over the past month, we’ve explored the different layers of chain abstraction, according to Frontier’s CAKE Framework, to uncover the components necessary for creating a seamless user experience in the modular ecosystem. We began by breaking down the Permission Layer, which governs access and ensures secure interactions between users and blockchains. Then, we delved into the Solving Layer, responsible for efficiently routing transactions across chains. Finally, we explored the Clearing & Settlement Layer, where the resolution of cross-chain operations takes place.

Today, we shift our focus to Particle Network, one of the projects at the forefront of account-level chain abstraction (the “account layer” is also known as the permission layer). Particle’s recent early access release of Universal Accounts (UAs), marks the first mainnet implementation of unified balances, introducing a new paradigm where users can access and manage their assets across multiple chains with a single account and unified balance—removing many of the friction points that have historically plagued multi-chain interactions.

In this article, we’ll break down the mechanics behind Universal Accounts, how they streamline onboarding and interaction, and their role in transforming the chain abstraction landscape.

Now, let’s unpack UAs in greater detail.

Universal Accounts

Universal Accounts (UAs) are a solution that abstracts the complexity of managing assets across multiple blockchains, allowing users to interact with decentralized apps (dApps) using a single, unified balance.

UAs aggregate user assets (tokens) across all chains, creating an experience where users can seamlessly travel from app to app using just one account. This eliminates the need to manually bridge assets, switch networks, or keep track of multiple accounts—a significant leap forward from the traditional user experience.

To illustrate, let’s walk through the current onboarding process most users go through:

Step 1: A user downloads a wallet like MetaMask to interact with the Ethereum blockchain.

Step 2: The user wants to interact with a new chain, like Base, Polygon, or Arbitrum. They manually add each network to their MetaMask wallet.

Step 3: The funds the user initially had on Ethereum are only available on Ethereum, meaning to use these funds on the new chains, the user must manually bridge the assets.

Result: This process costs time and money and requires users to track multiple balances across several chains.

Thus, we’re expecting that users not only take the time to manage these various balances but also bridge between them –this is essentially the problem that Universal Accounts aim to solve.

With Universal Accounts, instead of managing multiple accounts and balances, the user would only need to worry about one account and one balance—across all chains. There’s no need to manually bridge assets back and forth or pay separate transaction fees on each chain. A UA consolidates all assets into a single, unified state, making cross-chain interactions as easy as working with a single chain.

Even Easier Onboarding with Social Login

While experienced crypto users can create a UA by using their existing wallets like MetaMask or Phantom, Particle goes a step further for those who are completely new to crypto. You don’t even need to know what a wallet is. Thanks to Particle’s Wallet Abstraction stack, users can onboard with just a social login—whether it’s Google, Twitter—face ID, fingerprint, or some other familiar method/

Here’s how it works:

A user signs in using their social account.

Behind the scenes, Particle generates a Universal Account tied to this social login, meaning the user doesn't have to deal with wallets, private keys, or addresses.

This UA will automatically manage their assets and dApp interactions across all blockchains.

In the future, this could look as simple as logging into a dApp using your Google account, unlocking your UA, and seamlessly accessing all your assets, without ever worrying about bridging tokens or adding networks. The same UA, controlled by your social login, would be able to hold all your assets and take care of all interactions across any blockchain.

This frictionless onboarding process makes it easy for newcomers to dive into the world of web3 without being bogged down by technical hurdles, while also giving experienced users the option to link their existing wallets.

How UAs Leverage Account Abstraction

To understand how Universal Accounts achieves the aforementioned properties, it's important to look at Account Abstraction (AA)—a key component of the architecture.

Traditionally, blockchain accounts fall into two categories: Externally Owned Accounts (EOAs) and Smart Contract Accounts. Most users are familiar with EOAs, like those provided by MetaMask or Phantom, which rely on a single key pair (public and private key) for security and interaction. EOAs are limited in functionality, requiring manual transaction approvals and being susceptible to key loss if not properly handled. They’re fundamentally rigid accounts, capable of a narrow set of functions.

By contrast, Universal Accounts are powered by Smart Contract Accounts (ERC-4337) that enable Account Abstraction. This abstraction removes the reliance on a single key pair and instead uses smart contract code to control how an account behaves. This opens up new possibilities, including:

Signature Abstraction: Users can define custom authorization rules like multi-signature approvals, transaction limits, and social recovery in case keys are lost.

Fee Abstraction: UAs allow users to pay gas fees using any token from any chain, or even remove gas fees altogether by utilizing a Paymaster, where the application sponsors the fees.

Nonce Abstraction: UAs enable transaction batching, meaning multiple steps (like approving and executing a swap) can be combined into a single transaction/signature.

From Onboarding to Interactions: Where Universal Liquidity Comes In

While Universal Accounts streamline the onboarding experience for users—removing the complexity of managing multiple wallets and bridging assets—the interaction process still involves executing transactions across different chains. This is where Universal Liquidity and Particle’s solver system come into play.

UAs solve the problem of account management, but users still need to perform actions like transferring tokens or paying for gas across different networks. Universal Liquidity ensures that users can make these transactions seamlessly, without needing to know where their funds are located or which chain-specific token is required. This system automatically routes the most efficient liquidity paths, consolidating assets and handling gas fees across networks, further enhancing the user experience by solving interaction challenges in a multi-chain world; simply, users just use applications with assets they have on any chain –Universal Liquidity handles the excess actions.

Universal Liquidity enables users to perform cross-chain transactions seamlessly, allowing them to use funds from any chain to pay for transactions on another. Specifically, it operates through a solver-based bridging approach, where an off-chain entity (the solver) fronts the necessary funds on the destination chain, enabling efficient cross-chain movement of assets.

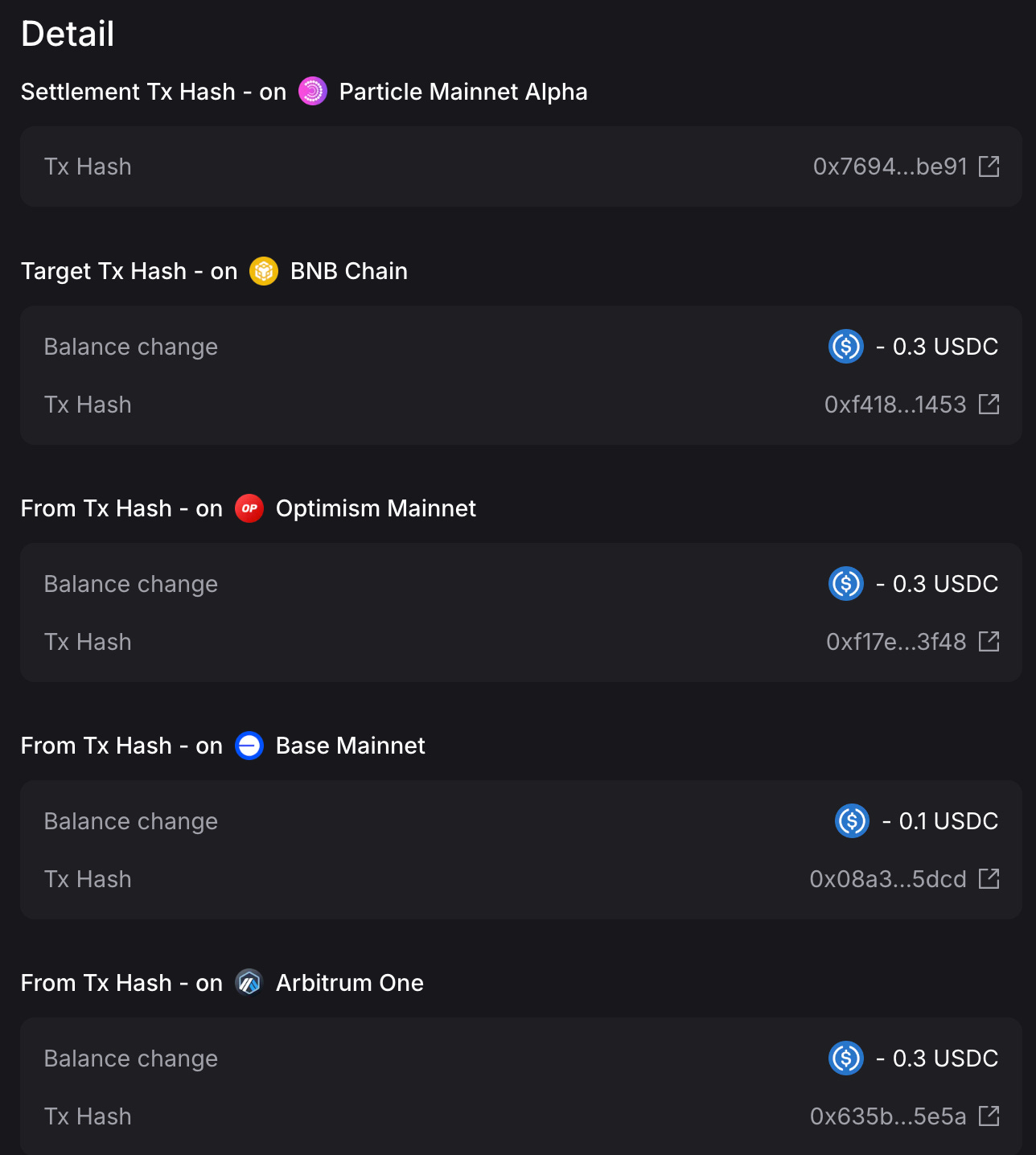

For context, Particle Network operates with an intent-centric approach, which means that when a user submits a blockchain operation using their UA, that operation is expressed as an intent. This intent message, eventually a sequence of transactions, is sent to and settled by the Particle L1, where one of Particle’s in-house solvers picks it up and fulfills the intent for the user.

Let’s take a look at an example to see how this works in practice:

Example: Minting an NFT Across Multiple Chains

Imagine you want to mint an NFT on Base, but your funds are spread across Polygon, Arbitrum, and Ethereum.

Step 1: You initiate the transaction to mint the NFT through the dApp, using your UA.

Step 2: Behind the scenes, a solver with liquidity on Base (the solver already has USDC on Base) steps in to execute the transaction on your behalf.

Step 3: The solver swaps their USDC on Base for ETH and purchases the NFT for you, instantly completing the transaction on Base.

Step 4: Now, the solver needs to be repaid. The funds you have spread across Polygon, Arbitrum, and Ethereum are converted into USDC and used to reimburse the solver.

As the end user, all you see is that your NFT was successfully minted. You don’t have to worry about bridging assets back and forth, acquiring the correct gas token, or even knowing which chain your funds were originally on. The Universal Liquidity system abstracts away these complexities, consolidating your assets and handling all the necessary steps under the hood.

By combining UAs with Universal Liquidity, Particle Network offers a user experience where you focus solely on the outcome (e.g., minting an NFT or transferring tokens), while all the heavy lifting—cross-chain movement, liquidity routing, and gas payments—is managed seamlessly behind the scenes.

Universal Gas

In addition to abstracting accounts and on-chain interactions, Particle further enhances the user experience by addressing gas fee concerns. With Universal Gas, when users submit a transaction using a Universal Account (UA), they have the flexibility to choose which specific token they would like to utilize for gas payments. This can be done using tokens available on the same chain or from another chain where the user holds additional capital.

This functionality is made possible through Particle’s native “Paymaster”, a system similar to that of the solvers involved in Universal Liquidity.

How the Paymaster Works:

The Paymaster acts as a sponsor for gas costs, maintaining a balance of the native network token, which is used to fund the transaction in question.

When a user selects their preferred token for gas, the Paymaster pays using the native token up-front, then repays itself using the token the user chooses.

After the transaction is executed, the Paymaster reimburses itself using the original funds that the user intended to use for gas, ensuring a seamless experience without the need for users to manually bridge or manage their assets.

The Particle L1

Particle Network uses a Layer-1 blockchain as the driver of Universal Liquidity and Universal Gas. This L1 acts as a universal settlement layer for the entire Particle ecosystem, designed not for deploying applications but to serve two primary purposes: storage and coordination of Universal Accounts (UAs).

1. Storage of UAs

Each Universal Account (UA) is a smart account that aggregates user assets across various chains. However, even smart accounts face challenges with fragmented state management. For instance, the state of a user’s account on Base could differ from their account on Arbitrum.

To address this fragmentation, the Particle L1 provides a reliable source of truth for all UAs, ensuring that smart account states (such as the signer) are accurately reflected across the ecosystem.

2. Coordination of UAs

When a user submits a transaction through their UA, this transaction message is routed to the Particle L1, specifically to an entity known as the bundler. The bundler’s role is to determine the most efficient path for executing the user’s intent, optimizing for both speed and security.

This architecture creates the perception of a unified balance for the user, even though realistically, it is just the swift movement of funds between multiple chains using a solver.

Universal Accounts In Action

A few weeks ago, Particle Network gave a select group of users early access to test their Universal Accounts (UAs). I was fortunate to be part of this group, and my experience so far has been nothing short of impressive.

It’s one of those moments where you think to yourself, “why wasn’t it always like this?”.

The onboarding process is incredibly user-friendly, with the option to connect an existing wallet or simply log in using Gmail or a social media account. This flexibility already sets Particle apart, as it reduces friction for newcomers who may not be familiar with traditional wallet setups.

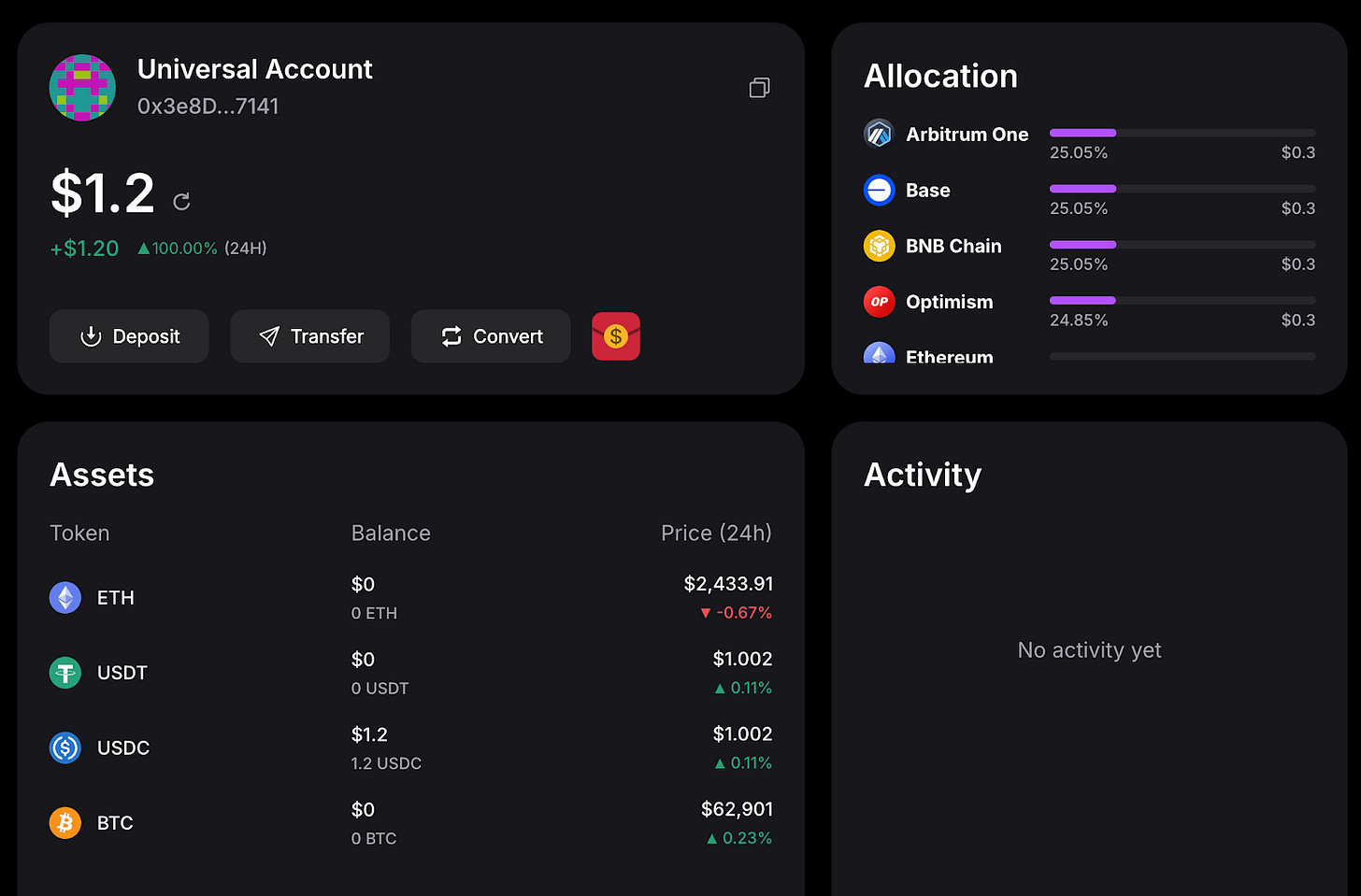

Once onboard, I needed funds to properly test the product. Fortunately, Particle has been treating early testers to virtual coffee. I was provided 1.2 USDC, spread across four different chains—Base, Arbitrum, Optimism (OP), and Binance Smart Chain (BSC)—with 0.3 USDC on each chain.

We can see the breakdown here in the UI:

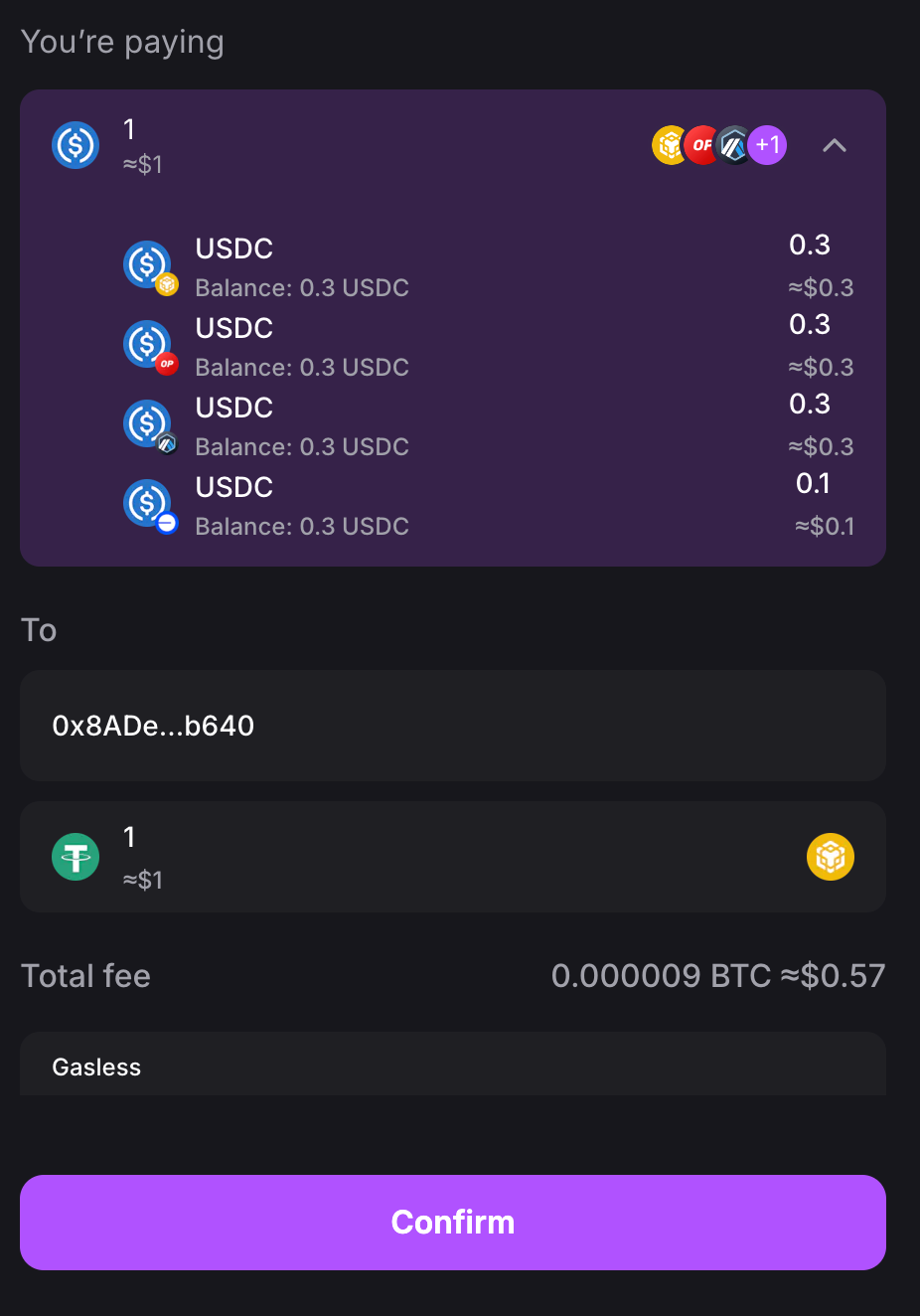

Despite these funds being scattered across multiple chains, the magic of UAs is that they appear as one unified balance. For instance, when purchasing a $1 cup of coffee, the system automatically combines the value from all four chains into a single transaction—no need to worry about manually bridging assets or managing gas fees.

In my case, the coffee was priced in USDT, but I only had USDC. Yet, I was still able to complete the purchase seamlessly. Thanks to Particle’s native Paymaster (as mentioned earlier), there were no gas fees involved—though this feature may depend on the dapp you're interacting with.

From the end-user’s perspective, everything feels instantaneous. But behind the scenes, several steps took place. My transaction involved bridging funds from each relevant chain and settling the final purchase on Particle’s L1. This complex process, invisible to the user, is all bundled into a single transaction with one signature—no manual effort required.

UAs Are Inevitable

Universal Accounts will likely have a sticky effect on users. Wallets have always had a degree of stickiness—once you’re comfortable with one, you’re less likely to switch. But the unified balance across chains is on another level.

For many, including crypto-native users like myself, checking wallets and managing assets across chains is part of the routine. But I believe there will be a significant portion of future users who will never even need to think about these things. They might not even realize they're using a "Particle wallet," and that’s okay! The best technology works behind the scenes, offering users an intuitive experience without technical friction.

The Broader Landscape

Of course, Particle Network isn’t the only team pursuing this vision of unified balances. In previous articles, we’ve explored other projects like Arcana Network, NEAR Protocol, and Capsule, all of whom are building solutions to streamline the user experience across multiple chains. While each team has its own architectural approach, the end goal remains the same: create a seamless, cross-chain experience for users.

Despite the efforts of many teams, the future wallet space will likely be dominated by only a few key players, just as we see today with MetaMask for EVM chains, Phantom for Solana, and Keplr for Cosmos. Of course there’s other successful wallets today, including Rainbow, Raby, etc., but then we have a long tail list of others with no where near the number of users as the top ones.

In the end, the first to capture the majority of users, starting with crypto natives, will have the upper hand, in my opinion. Once developers see which wallets users prefer, they’ll integrate those wallets directly into their dapps, further entrenching the dominant players. Newcomers to the space won’t want to deal with the complexities of seed phrases or switching chains. Instead, they’ll simply log in with their Gmail or social media accounts and begin interacting with dapps seamlessly.

Aside from having a first movers advantage in the market, the new era of wallets will also compete on other factors, including marketing and added wallet features, such as privacy.

Where does that leave current giants like MetaMask and Phantom? They’ll need to adapt or risk losing the next wave of users who demand a frictionless experience. Given the clear benefits of a unified balance, it’s likely these established players will adjust their strategies—either by building their own implementations, integrating existing solutions like Particle or Arcana, or perhaps even acquiring one of these emerging platforms altogether.

Give It A Try!

Do you want to be amongst the first to test these universal accounts out? We have 7 single-use, early access referral codes for you!

ZYLWXN, QHJ0PV, IN0AMF, IFTUSQ, NOFDWO, GE77KI, BGNWDI

Wrapping Up

Particle Network is one of the projects at the forefront of creating a seamless user experience, and allowing us to manage cross-chain interactions with ease. By seamlessly integrating Universal Accounts (UAs), Universal Liquidity, and Universal Gas, Particle aims to simplify the complexities that have traditionally plagued crypto users.

Imagine a future where engaging with dapps feels as intuitive as using any mainstream app today. Users will no longer need to navigate the intricate web of wallets, bridging assets, or worrying about gas fees across multiple chains. Instead, with Particle's technologies fully matured, onboarding will be as simple as logging in with a social account, and unlocking a universal account that manages assets across a myriad of blockchains effortlessly. Users will focus on their desired outcomes—whether it’s minting an NFT, participating in DeFi, or transferring assets—while the complexities of underlying transactions are handled seamlessly by the system.

Particle’s vision is about democratizing access to the decentralized future, where everyone can participate, create, and thrive in a cohesive ecosystem.

& a huge thank you to our two additional partners who helped us craft this series: Arcana Network, and Nuffle Labs.