Weekly Rollup #33

Introducing Chronicle Protocol | The Solana VM Reaches Ethereum | AltLayer's Autonomous Worlds Framework | Injective Launches inEVM | Can SVM L2s be performant enough? | Week ending September 22nd

👋 Welcome to Modular Media! We cover news, updates, educational content, and more within the modular blockchain ecosystem.

Subscribe to get posts sent directly to your email every week, and follow us on Twitter for modular-related updates!

This week’s issue covers:

Introducing Chronicle Protocol

The Solana VM Reaches Ethereum

AltLayer's Autonomous Worlds Framework

Injective Launches inEVM

More News & Announcements

Can SVM L2s be performant enough?

More Education & Discourse

📣 News & Announcements

Chronicle Protocol: Data Infrastructure for a Decentralized, Verifiable, & Interoperable Future

With a long history of innovation, Chronicle invented the first Oracle on Ethereum in 2017 to facilitate the creation of SAI and later DAI, and is best known as the exclusive Oracle of MakerDAO and the second largest Oracle by Total Value Secured, securing $5bn+.

However, if you haven’t heard of Chronicle yet - that’s for good reason. Access has only been opened up to the public this week. The team at Chronicle Labs has constructed it based on a core vision for a truly decentralized & interoperable future.

If we are to build this future, Chronicle argues that on-chain Oracles & data infrastructure need to change. Here’s a short deep-dive into how Chronicle aims to achieve that:

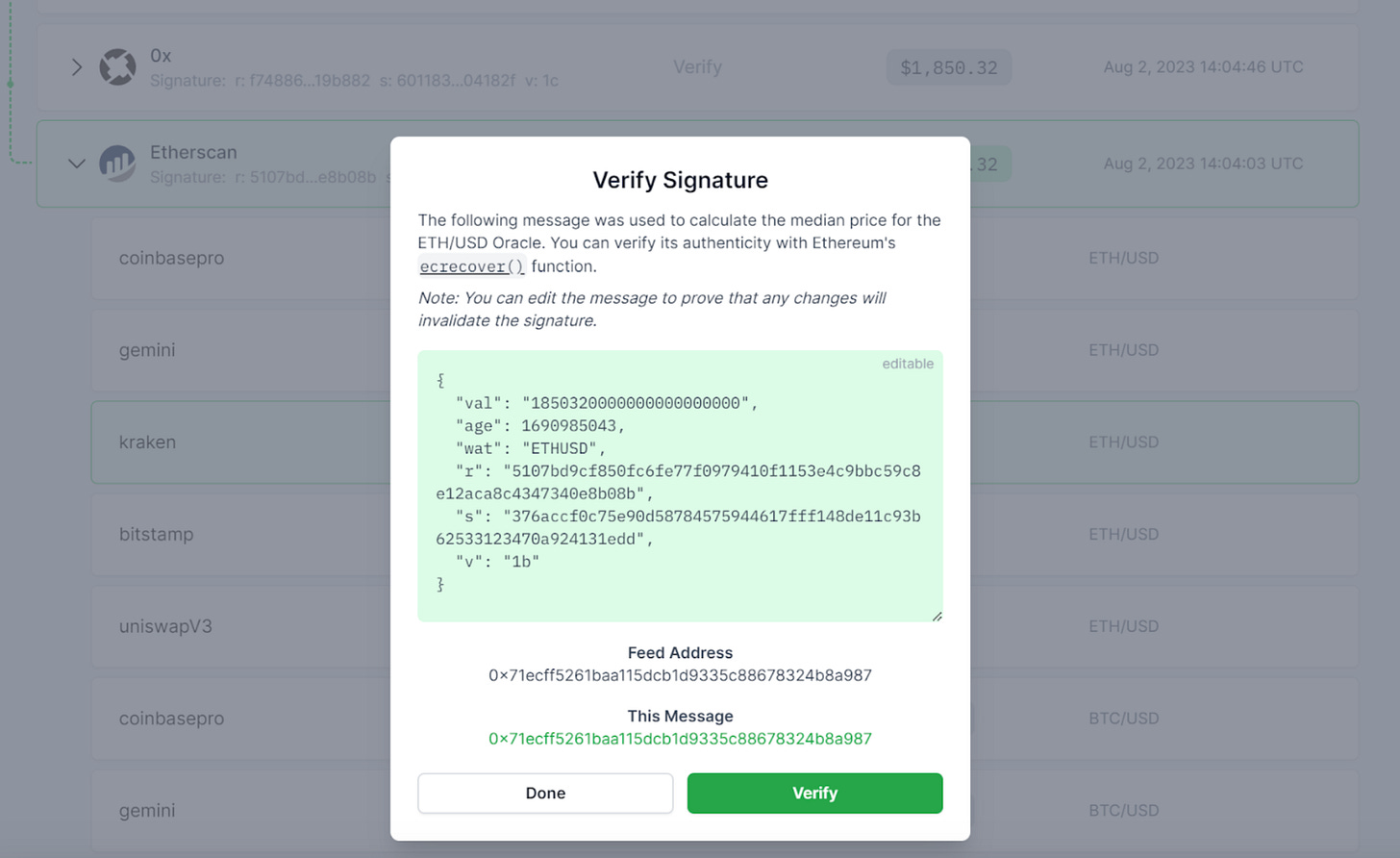

Verifiable Data

At the heart of Chronicle Protocol is the concept that all its data can be verified using the on-chain dashboard, The Chronicle.

This is an essential change for on-chain data protocols if the future of many of our everyday products and networks is to be decentralized. The data that those networks utilize to make decisions that impact users, such as the price of a token pairing for a DeFi protocol, must be verifiable, both historically and in real time.

Decentralized Data

All the core functions of Chronicle Protocol are decentralized, data is delivered via consensus, with a community of 22 Feeds, including trusted protocols such as Gitcoin, Infura, Argent, 0x, MakerDAO, Gnosis, dYdX, Etherscan, MyCrypto, and DeFi Saver.

Any user can run a Relay, and in-built fraud proofs allow a caller to auto-ban a data Feed found to be acting maliciously and manipulating values, with a reward in ETH - creating a new and positive MEV opportunity. Decentralized data protocols are essential for security but also resilience.

Interoperable Data

Chronicle Oracles have been designed for a single implementation across all chains, making them blockchain agnostic. This is important to ensure the same levels of security, verifiability, and decentralization across the vast network of Layer 1s, Layer 2s, and beyond.

Oracles must first be deployed on the target chain by Chronicle, with the first supported chains being Ethereum and Polygon zkEVM in collaboration with Polygon Labs. Chains such as Scroll, Optimism, and more are set to follow shortly after launch.

Cost-Efficient Data

The final and, perhaps, most interesting element of Chronicle Protocols' new Oracles is their gas usage optimization. Utilizing Schnorr signatures and secp256k1 public key aggregation, Chronicle has created a unique way to bring down the gas usage of Oracles on both Layer 1 and Layer 2 by over 60%.

Historically Oracles are highly costly to update, so this cost-efficient design creates the first iteration of an affordable Oracle, bringing down the barriers to entry for Web3 builders that need access to high-quality & reliable Oracles.

Explore ‘The Chronicle’ on-chain dashboard here (in beta). Stay up to date with the team’s journey by following them on X, or join the community on Discord.

Sponsored by Chronicle Labs

The Solana VM Reaches Ethereum

Last week, Eclipse announced the official architecture for Eclipse mainnet - a Solana VM (SVM) L2 on Ethereum - something most of us did not see coming, just one year ago.

Not only was this a big deal for the Ethereum and Solana ecosystems, but for the modular ecosystem at large, as Eclipse mainnet will consist of four different pieces of the modular stack:

Execution: Solana Virtual Machine (SVM)

Settlement: Ethereum

Data Publication: Celestia

Proving: RISC Zero

As David puts it:

The EVM & SVM?

Single-threaded vs. multi-threaded:

The EVM is single-threaded, which means transactions are processed one at a time.

While the SVM is multi-threaded, meaning transactions are processed in parallel (if they’re not touching the same state).

& this is also why you hear people on Twitter say “Solana (or the SVM) scales with hardware”. The quicker and more performant the hardware (the microprocessors) is, the more the SVM is able to scale - in other words, TPS increases.

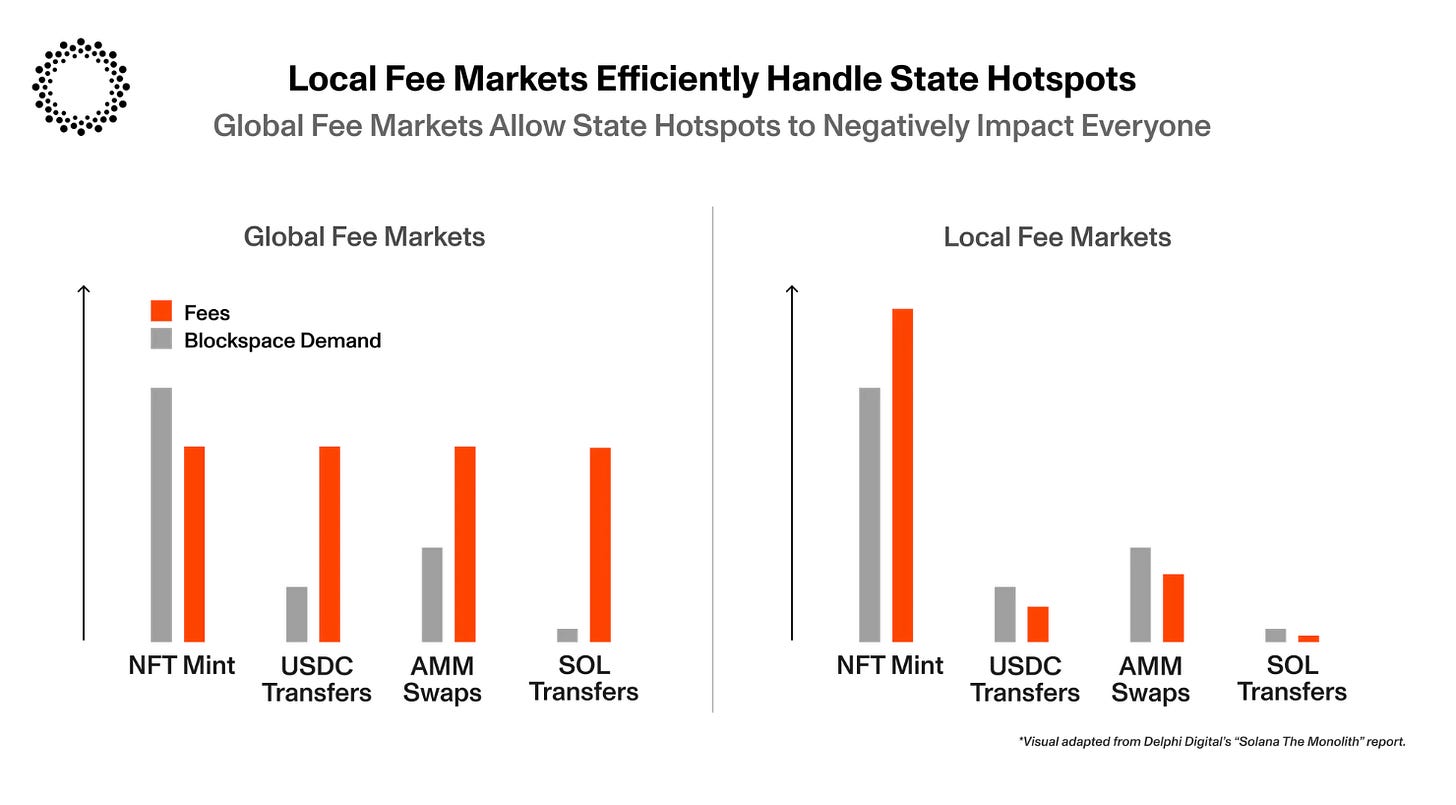

Global Fee Markets vs. Local Fee Markets:

The EVM has “global fee markets”, meaning if one of the apps deployed on an EVM chain (a popular NFT. mint for example) is experiencing extreme activity, then all the apps, & more importantly users, suffer from fee spikes as consequence.

The SVM has “local fee markets”, meaning fee spikes for a single app on the chain, doesn’t impact everyone else. If an NFT mint is experiencing high activity, only the NFT site suffers from fee spikes, whereas a defi app launched on the same chain wouldn’t.

State Growth:

You’ve probably heard by now, but the EVM suffers from the state growth problem. After every Ethereum block, the Merkle Tree has to be updated with the new state (who owns what), whereas the SVM merklized its state every epoch (2.5 days) - “This is much cheaper than real-time merklization”. Learn more about the state growth problem here.

Ethereum Settlement

Eclipse mainnet will settle on Ethereum, providing the chain with certain security guarantees.

bridge = canonical chain : Having Ethereum’s bridge enshrined within Eclispe mainnet, means that bridge is the ultimate source of truth for the chain. This is how Ethereum “enforces correct ordering for Eclipse”.

enforce withdrawals from L1: If for some reason, the Eclipse sequencer is withholding or censoring transactions (no one is processing our transactions), then we can always enforce a withdrawal directly from the L1 bridge. Obviously, this is not something that just anyone is able to do, which is why Neel (Eclipse founder) looks to be interested in issuing a grant to a team/individual looking to build a front-end for this.

Aside from security, settling on Ethereum will allow Eclipse mainnet to leverage the largest ecosystem of users, liquidity, & assets in the space. SVM performance, with EVM compatibility. One of the more interesting aspects of Eclipse is that $ETH will be the native gas token of the chain - something that most existing L2s today aren’t even doing.

Celestia Data Publication

Eclipse mainnet will be using Celestia for data publication, which is expected to be the first Data Publication network to go live on mainnet with full DAS support (Data Availability Sampling), and will bring the following benefits to Eclipse:

Throughput: The Eclipse team states this (not posting data to Ethereum) is the only way to achieve the level of throughput one expects to have with an SVM chain, “even after EIP-4844” (Proto-danksharding). As Eclispe mentions in their blog post, post EIP-4844, Ethereum will provide an average of ~0.375 MB blobspace per block, whereas “Celestia will launch with 2 MB blocks later this year”. Put simply, this means more stuff can fit inside Celestia blocks.

DAS Scaling: One of the cool things about Celestia (& other DAS solutions), is that its blockspace scales with the number of light nodes available. We’ve talked about Celestia & light nodes plenty of times in previous newsletters, but basically, light nodes can have full assurances that data is being published on Celestia, without having to download the whole chain. Rather, only a small “chunk” of a block is downloaded, and together, light nodes are able to combine these chunks to form the complete block of data. So, the more light nodes available, the more “chunks” are able to be verified, meaning more blockspace. More nodes also equals more security too btw :)

Low Fees: as you’re probably already aware, the most expensive aspect of an Ethereum rollup is posting its data onchain, so offshoring this task to another layer (Celestia) is much cheaper for not only the Eclipse chain but for the end-users interacting with the day-to-day apps.

& of course, Eclipse posting its data elsewhere places it under the “validium” category (it’s like a rollups cousin - lol).

RISC Zero Proving

Finally, we have proving, powered by RISC Zero.

Eclipse mainnet will be using a hybrid approach, using zk-proofs, under the optimistic design. In other words, zk-proofs are only generated when challenging a transaction (when you want to call 🐂💩 on something), which is opposite to the standard ZK approach of proving every single block. We talked more about this zk/optimistic design here. Of course, check out Eclipse’s full post to dive into the details of how its proof system, powered by RISC Zero, will work.

Closing Thoughts

Eclipse’s Rollup Framework & RaaS

We’ve spoken a lot about Eclipse in the past, but up until now, we’ve been talking about Eclipse as the RaaS team that helps other teams deploy their own SVM instances (rollups) - effectively placing Eclipse as the settlement hub for this ecosystem of SVM chains. In fact, some of the SVM chains they helped launch so far include:

Injective’s inSVM chain: defi

Nautilus Chain: defi

Polygon SVM

Worlds Chain: onchain gaming

Bullieverse: onchain gaming

Wynd Network (DePIN)

Illuminet (DePIN)

While I’m sure Eclipse’s SVM framework will continue to be available for teams to use, the Eclipse team has made it clear that Eclipse mainnet (the Ethereum L2) is the only chain they will be focusing on.

Unanswered Questions

The launch of an SVM L2 on Ethereum introduces new set of questions, that iIm sure most of us are looking forward to watching play out:

Will Solana apps migrate over to Ethereum? (take advantage of increased users & liquidity)

Will popular defi Ethereum apps migrate to the SVM? (MakerDAO?)

That said, it looks like Eclipse is off to a hot start, as they just announced a second devnet sign-up form for teams, considering the first one filled up already.

Celestia

Another interesting aspect to point out is the huge win for Celestia this is as well. Celestia is expected to launch on mainnet soon, and depending on how successful Eclipse turns out, a good amount of value would potentially flow to Celestia from the get-go.

The more active Eclipse is, the more data is posted on Celestia

More data means more $$ to validators & light nodes

more revenue may incentivize more people to run a light node

more nodes means more security, and more blockspace (more people to check data)

more security & scale may incentivize other apps to launch on Celestia

& so on.

Because Celestia is still on testnet, Eclipse mainnet is still a short while away from reaching mainnet itself. However, for teams wanting to start building on Eclipse, you can sign-up here.

Eclipse mainnet is not only a huge deal for Ethereum & the SVM, but for the modular community at large. Congrats to the Eclipse team 🫡

AltLayer Launches an Autonomous Worlds Rollup Framework

Last week, Altlayer announced the launch of Turbo, a rollup framework dedicated to the building of autonomous worlds.

What are autonomous worlds?

Autonomous Worlds (AW) “are multi-author, highly persistent virtual realms that not only accommodate multiple inhabitants but also empower them to contribute to the expansion and development of these digital domains”. Put simply, these are “onchain games”, or “virtual worlds”, that are developed and governed by the community at large, not solely by the initial developers who built the game. Rules of the world run onchain, and the inhabitants of these worlds are the ones who determine these rules.

On top of that, autonomous worlds allow for the permissionless innovation on top of these virtual worlds - any developer can build an app that calls upon these virtual worlds, without permission from the initial world developers. Just think of this as modding.

That said, as the AltLayer team writes in their blog post, “today’s Autonomous Worlds however do not offer an ideal experience to its inhabitants”, which brings us to Turbo.

What does Turbo offer

Autonomous Worlds require very high throughput (don’t want to play in a laggy game), which is why many believe the optimal place to deploy an autonmous world, is on its own chain, or rollup.

AltLayer is one of the teams working to enable the deployment of these worlds within their own rollup. Initially, AltLayer offered teams the ability to deploy their own onchain games using existing rollup frameworks. Now however, teams have the ability to deploy their AW with Turbo, which is “optimized for Autonomous Worlds”. Some of the distinct features Turbo offers include:

near-instant confirmation times: Turbo processes transactions “almost instantaneously”, with block production reaching “as fast as 200 milliseconds” according to the team.

gas customization: Imagine turning on your PS5, logging into Apex Legends for the first time, and having to (1) buy “Apex points”, and then (2) send them to your account before you can even start playing. And then imagine having to pay a gas fee every time you change the skin on your character, or every time you pick up a new weapon during a match - it would be unplayable! Well, this is pretty much the current web3 gaming experience - but, Turbo aims to eliminate this UX nightmare. “One can disable gas pricing within the AW rollup stack, enabling zero-cost transactions”. I do have a question as to how they’re doing this - is AltLayer itself taking care of the cost of posting data to Ethereum?

Horizontal Scaling: Can launch your app (AW) across more than one rollup at a time to increase scale and performance. This is an interesting idea, as it opens the possibility to launch different rollups for the same app, based on user location (a rollup for US players vs one for EU players for example), or by some other standard.

Other features for Turbo include “dynamic block production rate”, “Burner wallet management system”, and “Variable random numbers (VRF) oracle” (via Automata). Make sure to check out the complete post to learn all about Turbo and the features this new rollup framework offers.

Injective Launches inEVM

Last week, Injective announced the launch of inEVM, an EVM rollup connecting to the broader Injective ecosystem.

Background

Development of Injective first started about three years ago, with initial plans being the launch of an order book DEX on top of Ethereum. However, the team looked at some of the disadvantages provided by the EVM (performance inefficiencies and high gas costs) and decided to launch their own L1 chain using the Cosmos stack. Rather than having this L1 be solely for its order book DEX (which, again, was the initial plan of the Injective team), it’ll be built for the defi ecosystem at large. More specifically, teams would be able to leverage pre-built “defi modules” to more quickly deploy their defi app on Injective, while also taking advantage of the chains ecosystem (users, liquidity, apps).

Fast forward to just a couple of months ago, Injective announced the launch of Cascade (now inSVM), the first IBC-connected Solana VM rollup. This (1) brought the highly performant SVM to Injective, and (2) allowed Solana developers to deploy, or migrate their apps from Solana to Cascade, allowing them to leverage Injective’s ecosystem, as well as providing IBC-connectivity.

This brings us to last week’s announcement of inEVM.

What is inEVM

inEVM is Injective’s third third-chain deployment and is powered by Caldera’s 1-click rollup solution (RaaS).

Recall we have the first Cosmos SDK chain (the Injective Hub), inSVM, and now inEVM. According to the team, regardless of which of these three chains you deploy your app on, it’ll be composable with the other two - “dApps launched on the inEVM layer would be able to compose directly with Cosmos and Solana applications”.

For Ethereum developers, this means they would be able to deploy their Solidity smart contracts (apps) on top of inEVM without having to make major modifications, thereby allowing them to access Injective’s own ecosystem and user base. The team also mentions other benefits for developers, including:

high-performance thanks to its parallelized structure

instant transaction finality: 1-second block times

modular toolkit: the “plug n’ play” defi modules

shared liquidity: access liquidity across the entire Injective ecosystem at large

“composability across the Cosmos IBC universe alongside Solana”

Some of Injective’s biggest apps today include:

Helix: exchange built by Injective team

Mito:: trading & yield generation streategies

Frontrunner: sports prediction market

Astroport: popular AMM within the Cosmos ecosystem

You can check out the full ecosystem page here.

I’m not sure how entirely accurate this is, considering not all apps are displayed, but according to defillama, Injective Hub has a TVL of close to $21M, with $2.15M in 7-day volume across the chain. Nonetheless, the number is not so great, especially compared to the top EVM chains - launching on the EVM may provide them with the increase in users & volume they need.

To learn more about inEVM, you can check out the complete post, here.

More News & Announcements

Pocket Network will be launching its own Celestia rollup using Rollkit’s rollup framework.

Conduit (RaaS solution) announces support for Arbitrum Orbit, allowing developers to quickly launch their own EVM, or Wasm rollup using Conduit.

Aztec launches “Aztec Sandbox”, a testnet for developers to start experimenting and deploying smart contracts. They also recently “decentralized the sequencer”, and released a smart contract framework.

Check out the list of integrations Caldera has made available for those wanting to deploy their own custom Caldera Chains (rollups). From bridging protocols to sequencers, DA, oracles, & more.

RISC Zero hosted a Twitter Space discussion about “Zeth & the future of zkEVMs”

Catalyst announced Lynx testnet, which is going live on the 27th. This follows up on the previous testnet which was just deprecated days before.

Optimism is now live on Omni’s testnet, providing OP STack developers with another L2 bridging option.

Avail launches a new initiative (”Uncharted”), “to collaborate with the community on foundational and exploratory projects”. In other words, to contribute to building tools and infrastructure for Avail. “You can see the current projects in the Avail Uncharted Repo.” Some things the Exploration team (team behind this Uncharted initiative) has already been working on include: OpEVM, ZK apps, and adapters. Check out the blog to learn more.

Eigen Layer partners with Cubist to bring “anti slashers” to EL. This will basically prevent honest validators from getting slashed due to a bug or some other issue they had no part in.

Taiko launches its Alpha-5 testnet, introducing “a new Proposer Builder Separation (PBS) inspired proposing and proving design”. Here are some numbers shortly after launch. Taiko also announced an ambassador program.

Teams can start applying to Mantle’s latest grant round.

Introducing Aerv Finance, an LST solution launching on Fuel (Eth L2).

Check out the two winning projects from Scroll’s (Eth L2) recent Permissionless hackathon.

Proof of Play, an onchain game studio, announced a $33M seed round, led by a16z.

zkSync announced a 4-6 month fellowship program, with successful applicants earning $3,500 per month.

Teams can start applying to Optimism’s RetroPGF 3. Learn all about this here.

Base announced the launch of Pessimism, a new monitoring system to increase security of Base, along with other OP Stack chains.

BWare Labs just released a new Optimism Goerli faucet.

Canto becomes the latest project to announce the launch of their own zkEVM powered by Polygon’s CDK.

L2Beat comes out with a new approach to TVL “to account for L2 tokens that do not originate from Ethereum”.

Check out FOAM, an OP Stack chain that features a “proof of location” protocol.

Biconomy launches Smart Accounts Platform, pluggable UX components developers can leverage into their dapps.

Polygon founder submits a proposal for Celo to become its own zkEVM, using Polygon CDK.

📚 Discourse & Education

Can SVM L2s be performant enough?

ZenLlama from Monad questions whether there’s a “catch” to the Solana-performance-on-Ethereum narrative gaining momentum after the Eclipse announcement.

He points out two potential problems:

Bandwidth

Value accrual

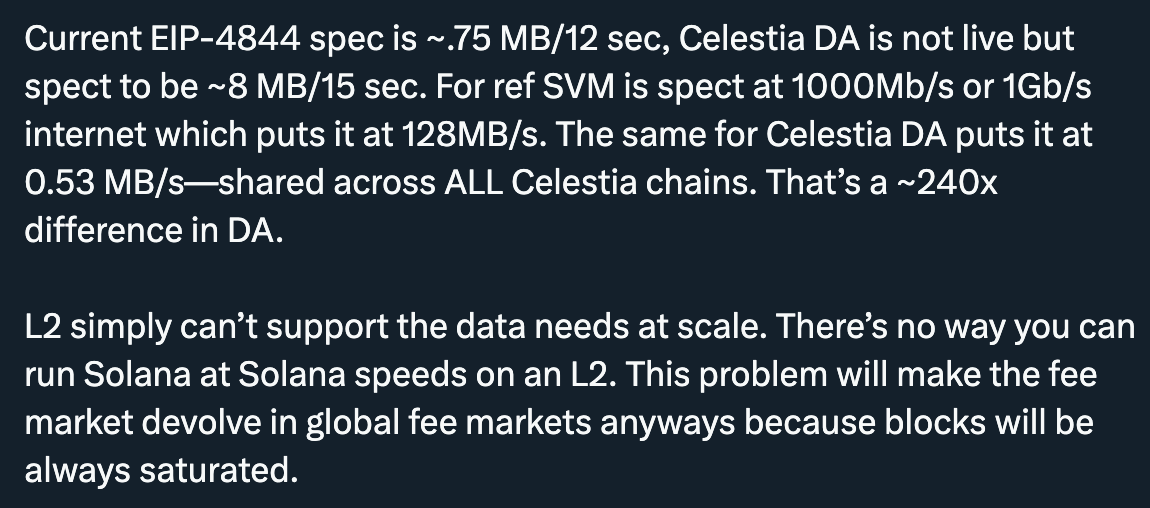

Here’s the bandwidth argument:

He brings up a good point. Is it possible that SVM L2s like Eclipse won’t be able to handle the same throughput as Solana L1? If so, does that make it pointless?

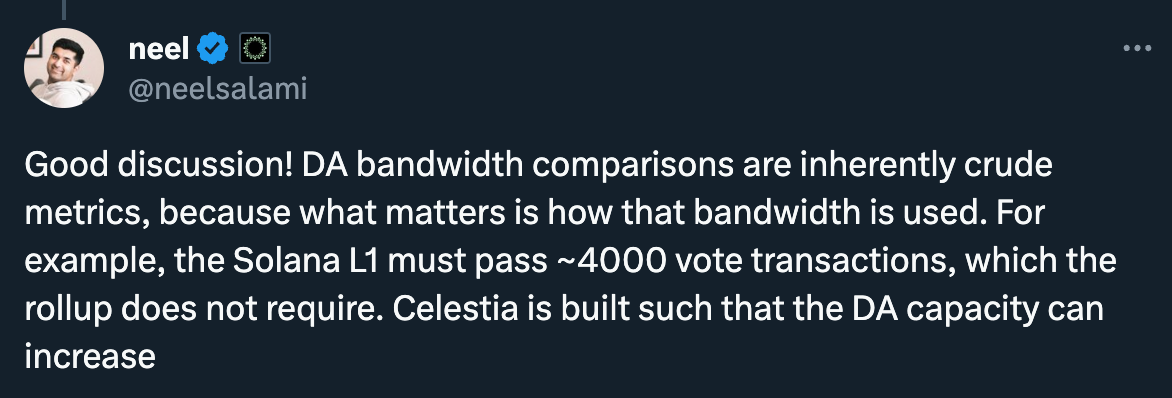

Neel from Eclipse addresses this concern, making it clear that it’s an apples-to-oranges comparison. Even though Solana-on-Ethereum is a good mental model, it is not quite technically correct. For example, Eclipse can actually remove some aspects that Solana L1 is forced to do, such as voting. As Neel points out, voting contributes a very signifant number of transactions, thus taking up a lot of bandwidth. Stripping out votes makes a huge different (votes take up 90% of Solana activity!).

Put simply - even if current DA bandwidth makes the SVM L2 highway smaller, there are also less cars traveling.

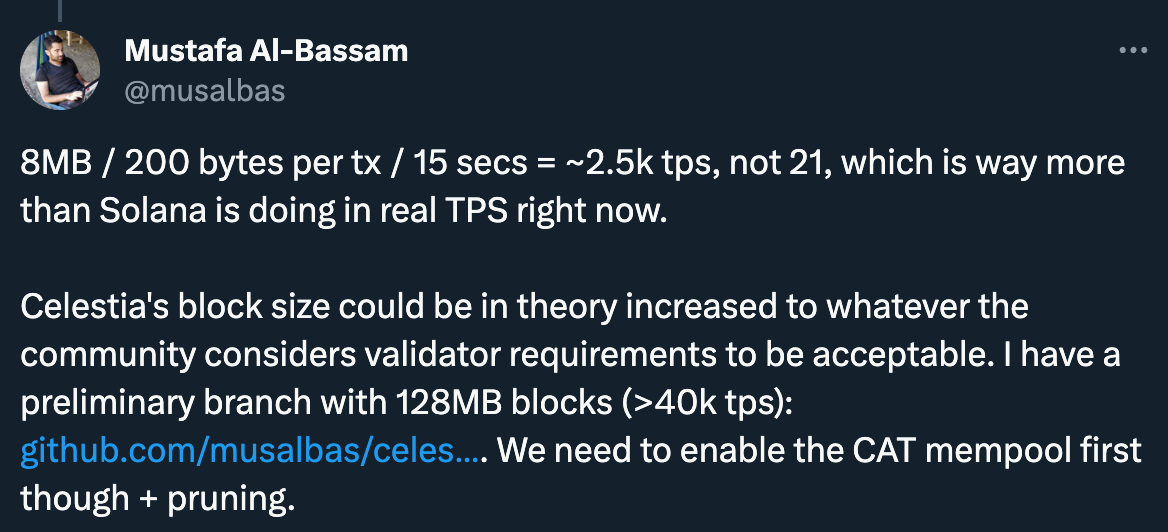

It’s also worth noting that the real bottleneck underlying ZenLlama’s criticism, L1 DA bandwidth, is also an apples-to-oranges comparison. As Mustafa from Celestia points out, Celestia bandwidth can be configured higher over time without much trouble or negative security impact.

More Discourse & Education

Bankless discusses the new SVM L2 on Ethereum with Neel from Eclipse 🎙️🔥

@LoganJastremski discusses parallelization, local fee markets and more with Neel from Eclipse 🎙️

@daniel_d_kang breaks down TensorPlonk: a “GPU” for ZKML, delivering 1,000x speedups ✍️🧠

Bankless discusses blobspace and its economic impacts with Dom from the Ethereum Foundation 🎙️

Delphi Digital discusses how “intents are real” with Chris from Anoma 🎙️

@stonecoldpat0 explains how MEV is enabled in blockchain systems, how it differs in L1 vs. rollup contexts and more ✍️

@yuxiao_deng deep dives into Proposer Commitments (PCs), covering solutions like PEPC, PEPC-DVT , PEPC-Boost, Mev-Boost+/++ ✍️💎

@0xCygaar explains how Eclipse’s new Solana x Ethereum rollup works 💬

Web3 Builders discusses Lido as a systemic risk with Danny from Ethereum Foundation 🎙️

Taiko discusses based rollups and decentralized sequencing 🎙️

@mikeneuder explores the design space around enshrined Proposer-Builder Separation (ePBS) ✍️

@0xJim explores Relayer Extractable Value, the REV supply chain and more ✍️

a16z crypto discusses how to decide what blochchain to build on 🎙️

Aztec discusses Fernet, their decentralized sequencer selection protocol 🎙️

@0x_emperor explores multidimensional blockchain fee markets ✍️

Risc Zero discusses Zeth and the future of zkEVMs 🎙️

@apolynya explores hybrid applications and infra providers as development studios ✍️

@zerokn0wledge_ explains how EigenSettle can offer fast settlement guarantees 💬

@khushii_w breaks down UX approaches from her talk at Intents Day (SBC)

@WestieCapital highlights key takeaways from Permissionless 💬

@stacy_muur highlights decentralized social protocols 💬

@0xperp explains why blockspace is a class of commodities ✍️

That's all for this week! Thanks for reading 🧱🎬