Weekly Rollup #42

Move VM rollup 🤝 Ethereum | Polymer pivots to L2 | Cosmos Hub Forking? | Blast and L2 experimentation | Beyond TPS as a success metric | Sequencer spoiler alert | Week Ending November 24th

👋 Welcome to Modular Media! We cover news, updates, educational content, and more within the modular blockchain ecosystem.

Subscribe to get posts sent directly to your email every week, and follow us on Twitter for modular-related updates!

This week’s issue covers:

Move VM rollup 🤝 Ethereum

Polymer pivots to L2: Ethereum’s IBC Hub

ATOM inflation reduction may cause Cosmos Hub fork

More News & Announcements

Blast and L2 experimentation

Beyond TPS as a success metric

Sequencer spoiler alert

More Education & Discourse

📣 News & Announcements

Move VM rollup 🤝 Ethereum

Movement Labs just unveiled M2, an Ethereum L2 network powered by the Move VM, and using Celestia for data publication, further helping reduce gas costs for end-users.

The Ethereum community is set on scaling execution via rollups (L2s), and as such, we have seen Ethereum become somewhat of a universal settlement layer (the settlement layer is where the rollup publishes its proofs to reach finality).

While most Ethereum L2s are EVM-based, we are now starting to see more and more innovation hit Ethereum’s execution layer, including Fluent’s Wasm-based L2, Eclipse’s SVM-based L2 (Solana VM), and the Fuel VM - well now, the Move VM is added to this list.

So why Move VM?

Move VM execution is “capable of 145K TPS”, and has “local fee markets to mitigate gas spikes”.

Local Fee Markets: In short, this means that extreme activity on one app (within the L2), will not affect every other app within the same L2 - in other words, no fee spikes on a defi app because of a hot NFT mint.

We’ll leave the explanation of how this works, along with all the other features of the Move VM, to the giga brains from the Movement Labs team.

Movement x Celestia

If you recall, Celestia unveiled Blobstream a couple of weeks ago, which as a reminder, is essentially like a bridge that connects Ethereum & Celestia. We talked in more detail about Blobstream in a previous newsletter, here.

What is Movement, and how did we get here? From M1 to M2

Movement Labs first unveiled their project following a recent $3.4M raise, and announced their plans of building an entire ecosystem of Move VM chains. Along with this unveiling, was the release of M1, “the first Modular Move L1 on the market”.

Movement Labs is also building tools and infrastructure that teams can leverage to build their own Move VM chains - in other words, a rollup framework for the Move VM.

Check out the full post to learn more.

Polymer pivots to L2: Ethereum’s IBC Hub

Those of us who missed the IBC Summit in Istanbul this past week probably didn’t catch a recent big piece of news (it was hardly mentioned anywhere 👀) - Polymer will be transitioning from a Cosmos appchain to its own OP Stack L2, as it looks to become the IBC Hub for Ethereum rollups.

What is Polymer & what was it building before?

As a reminder, IBC is an interoperability solution, traditionally only used across the Cosmos ecosystem. Polymer’s goal was always to bring IBC to Ethereum and its L2s.

Initially, they intended to do this by building their own Cosmos SDK appchain (an L1) with an IBC connection to Ethereum, however, according to Polymer founder Bo Du, he thought the best way to gain adoption from Ethereum-aligned rollups was for Polymer itself to become an L2. Minimize trust.

It has also been confirmed that Polymer will be leveraging EigenDA. To help break this down a bit:

Eigen Layer is a restaking protocol that enables staked $ETH to be used for security across other chains.

EigenDA is a data publication network that leverages this restaking protocol

Rollups & L2s need to publish their data somewhere so that the L1 (Ethereum in this case) knows what’s going on in the L2. Typically this is done on Ethereum, however, Polymer will instead post its data to EigenDA, which is much cheaper.

Cosmos 🤝 Ethereum

According to Bo Du, Polymer will not only be able to connect L2s with each other, but also connect the Cosmos and Ethereum ecosystems at large with one another.

Ethereum rollup → Polymer → Ethereum rollup

Ethereum rollup → Polymer → Cosmos appchain, and vice versa

While there’s not much info about this yet, “more details to come” soon, so make sure to follow them on X, or subscribe to Modular Media so that you don’t miss any new updates. That said, here’s a great video interview with Polymer founder Bo Du to get you started, going over more of the technicals of this update. Polymer is expected to hit testnet in Q4 this year and mainnet sometime in Q2 next year.

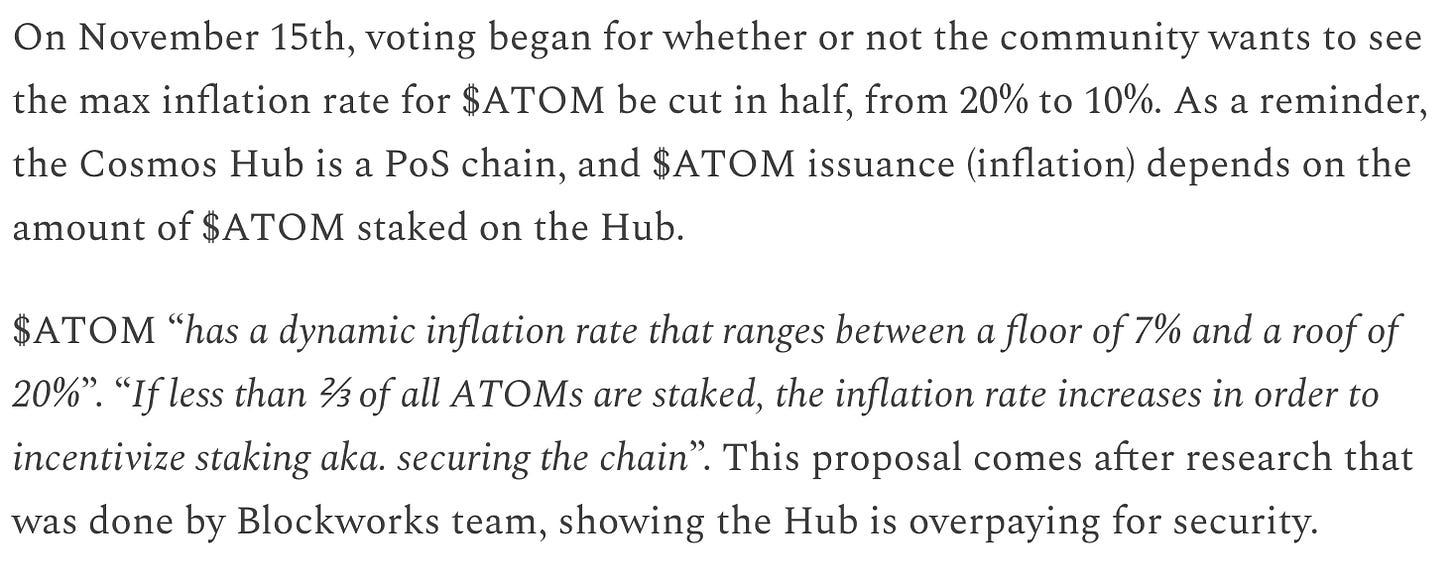

$ATOM inflation reduction may cause Cosmos Hub fork

The Cosmos Hub community has decided - the max inflation parameter will be cut in half, from 20% to 10%.

For those of you who missed it, we covered this proposal in a bit more detail in last week’s newsletter:

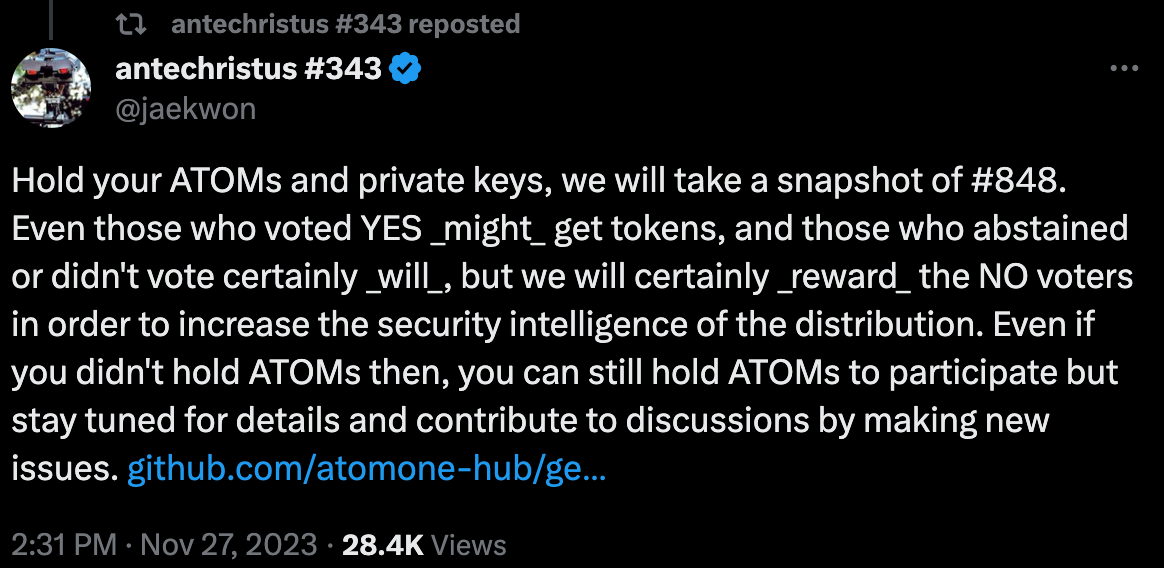

This was quite a controversial proposal, as you can see from the 72.7% voting turnout rate (highest ever). Given the results, it looks like Cosmos founder @JaeKwon may be launching a fork soon.

@lurkaroundfind from Stride wrote this really great thread covering some of the details behind this, and why it may actually be a good thing for the Hub community.

So, $ATOM holders may be in line for another airdrop 👀

Things are definitely getting interesting in the Cosmos community 👀🍿

More News & Announcements

You can now use Range to monitor Celestia addresses, IBC transactions, & $TIA balances.

Check out some of Avail’s features that separate them from other data publication networks.

A couple of members from the Clave team built SUClave, “A New AMM Design That Utilizes Intents (SUAVE) and Uniswap V4 to Address the LVR - LP Profitability Problem”. @doganeth_en breaks this new design down in the thread.

Google Cloud becomes one of the 65+ node operators for Eigen Layer testnet.

Fiefdom will be building a “metaverse-centric” Arbitrum L3, using Caldera’s RaaS. While developers can start building products and experiences on the chain’s testnet today, users will have to wait a couple more weeks.

Check out ZupaChain, a new RollApp powered by Dymension (IBC rollapps), and Celestia (data publication). Looks like it was built as an experiment to demonstrate “the future of modular general-purpose rollapps might look like”. Thread includes a guide on how to get started (adding network to wallet and accessing tokens from faucet), as well as some onchain stuff you can start doing today. Please be very careful and remember we don’t endorse anything here.

Dymension just opened up a community forum to discuss research, governance, and more.

Eigen Layer released an “ecosystem page”, enabling users to view the list of AVs, rollups, and operators working with the restaking protocol.

Optimism’s @ben_chain published a proposal for the ApeDAO (BAYC) to build its L2 chain with the OP Stack and join the Superchain.

Now, anyone can run a node on Zora’s L2 chain, enabling anyone to contribute to the network’s security and decentralization.

Check out Superform Protocol: : ”Users can execute into an arbitrary number of vaults on any chain, using any token, in a single transaction”. Superform will be integrated across eight networks to begin: Ethereum, Optimism, Base, Arbitrum, Polygon, BNB, Fantom, & Avalanche.

$USDC may be coming to your favorite EVM chain/rollup: “EVM blockchain & rollup teams can now deploy a bridged USDC token contract with optionality for Circle to seamlessly upgrade to native issuance in the future”.

Kinto announces that they will be migrating their defi-centric L2 to the Arbitrum stack. Here are the rest of the latest project deployments on Arbitrum, including “Captain & Company” (onchain game), Rarible (NFT marketplace), and several others.

Here’s the latest from the Scroll ecosystem (zkEVM), including their submission to Circle’s bridged $USDC program, top Scroll-based hackathon winners from EthGlobal, and early mainnet metrics, such as $40M in TVL, and a +4.5M transaction count.

Here’s the latest from the zkSync ecosystem, including the upcoming launch of Common wealth’s web3 investing platform, the launch of Deri V4 (futures, options), & more.

Vistara Labs announces its pre-seed raise, as they look to build a “hardware availability layer”. We talked more in detail about Vistara and it’s HAL in our previous newsletter, here.

Pragma (oracle solution) is now live on Starknet.

📚 Discourse & Education

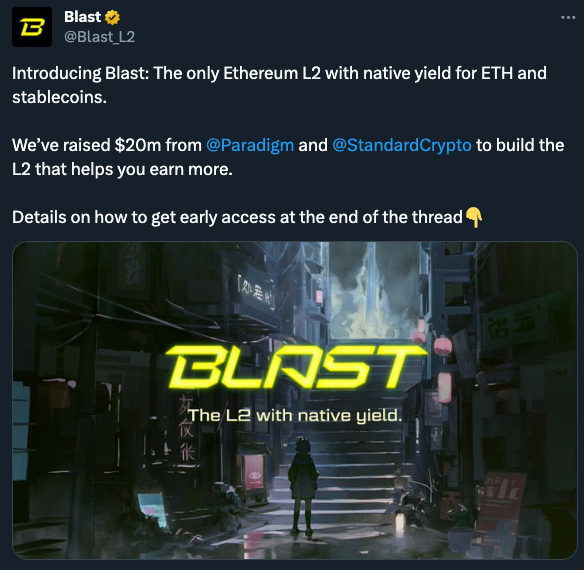

Blast and L2 experimentation

Last week, Blast was introduced and it stirred the CT pot.

We won’t get into many details about Blast, because well, there aren’t many details available about Blast, but TLDR it’s a new L2 project that offers “native yield” on ETH and stablecoins. The idea is that, as a user, you earn yield when bridging into the network. This is accomplished by the Blast bridge lending your tokens to Lido and Maker to be used in their services, and passing the earned yield back to you. This increases capital efficiency relative to other L2s where locked tokens are sitting and not earning yield.

Pro: You automatically earn yield just by using the L2

Con: Added trust assumptions (you are trusting Lido and Maker) worsening L2 security

So… there’s a new L2 with a new tradeoff. Why did this get so much attention?

The reason for the buzz is the juxtaposition between Blast’s implementation and the traction it gained. Blast’s only live component is a 3/5 multi-sig and there’s no real L2 product, yet they’ve reached over $500mm in TVL within a week 🤯 To be very clear, this means people deposited $500mm into a upgradable multi-sig controlled by 5 people, in record time, for the promise of product, yield and an airdrop.

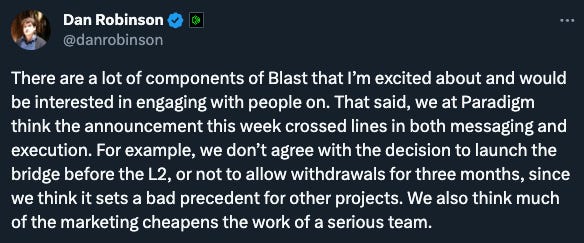

Many people were not happy about Blast:

That said, the majority of backlash came from Blast’s execution and marketing, not the idea itself. The consensus seemed to be “native L2 yield is interesting but Blast lost credibility with their implementation and marketing”.

Here are a few takes reflecting the above sentiment:

Even Paradigm, Blast’s lead investor, disagreed with how the L2 handled things (and they obviously like the idea)

It’ll be interesting to see what kind of effects this has on the L2 landscape and future deployments.

Here are a few opinions on the broader implications:

Beyond TPS as a success metric

As rollups proliferate and gain real user traction, it’s worth revisiting how we measure their success.

Are there better metrics than TPS?

@dmihal suggests we make user actions the focus point.

What do you think anon? DM us with your perspectives!

Sequencer spoiler alert

And here’s Toghrul with the weather on rollup forced inclusion and why sequencers aren’t in charge of rollup security.

His comment reminds us that there are different ways to decentralize sequencers.

More Education & Discourse

Placeholder explains how rollups are “virtual blockchains” in the modular era ✍️🔥

Archetype breaks down the MEV landscape, order-matching systems of today and the crypto exchanges of tomorrow ✍️

@TheInterop discusses Polymer’s pivot to an OP Stack rollup focused on interoperability 🎙️💎

@jiayaoqi summarizes Sreeram from EigenLayer’s talk on data availability mythbusters from Devconnect 💬💎

@ceterispar1bus breaks down all things Anoma and Typhon in part 3 of Delphi Digital’s Anoma series ✍️

Taiko explains Fully Homomorphic Encryption (FHE), how it works, and how it’s connected to ZK and MPC ✍️🔥

@MohamedFFouda explains how FHE enables private shared state 💬🧠

@cwgoes explores what intent-centric blockchain topologies might look like ✍️

@musalbas explains why data unavailability cannot be slashed on restaking-based DA layers 💬

@0x_emperor explores how blockchains could become a privacy layer for AI, covering MPC and transformers ✍️

Empire discusses L2 fragmentation, DAO governance pros / cons, the crypto market 🎙️

@david_of_earth explores verkle trees and how they enable constant-sized state proofs via the KZG scheme ✍️🧠

0xResearch discusses token holders vs. app users and which matters most 🎙️

DIA discusses all things Linea with Declan from Linea 🎙️

@randhindi explains how FHE can solve compliant programmable privacy ✍️

Bell Curve discusses liquid restaking and why it’s coming sooner than you think 🎙️

@0xyanshu explains why validity proofs and data availability are such important innovations for blockchain scaling 💬

@apolynya explains why blockchains are centralizing forces, but that it’s ok ✍️🧐

@zerokn0wledge_ explains how Composable Finance enables trustless composability across rollups 💬

@bloomberg_seth frames the key modules in the emerging wallet stack 🖼️

@poopmandefi analyzes the current activity and future of Base 💬

That's all for this week! Thanks for reading 🧱🎬